Important Update for Freelancers and Small Business Owners: New IRS Reporting Requirements Ahead

December 13, 2024 - 17:45

Attention freelancers, independent contractors, business owners, property renters, and occasional sellers! Starting January, there will be significant changes in how income from payment apps and online marketplaces is reported to the IRS. If you utilize platforms such as Venmo, CashApp, Airbnb, or Etsy to accept business-related payments, you may begin receiving 1099-K tax forms.

This new requirement means that these platforms will be obligated to report transactions to the IRS if you exceed certain thresholds. Specifically, if you receive over $600 in payments for goods or services, you will be issued a 1099-K form, which details your income for tax purposes.

It’s crucial to keep accurate records of your earnings and expenses throughout the year to ensure you can report your income correctly. As the tax season approaches, be prepared for these changes, and consider consulting with a tax professional to navigate the new requirements effectively.

MORE NEWS

January 29, 2026 - 03:32

‘Trust, love, commitment’: Esteemed business leaders and former Notre Dame football student-athletes reflect on how to be champions of hope at Walk the Walk Week eventOn Monday, two distinguished business leaders and former Notre Dame football student-athletes, Tracy Graham and Byron Spruell, shared their insights on cultivating hope during a keynote address....

January 28, 2026 - 04:04

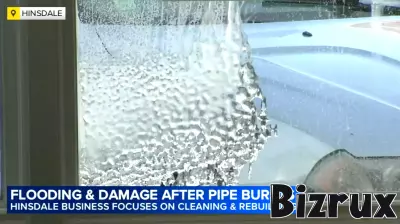

Hinsdale business owner facing thousands in damage after water pipe burstA Hinsdale business owner is grappling with the extensive aftermath of a devastating flood caused by a burst water pipe. The incident, which occurred unexpectedly, unleashed a torrent of water...

January 27, 2026 - 09:40

Want to Fly Business Class to Europe for Less? Try This Airline You've Never Heard ofFor travelers dreaming of crossing the Atlantic in business class comfort without the staggering price tag, an unexpected solution may lie with lesser-known carriers. While major network airlines...

January 26, 2026 - 20:09

Robotic cardiac surgery building momentum thanks to RAVR, other breakthroughsThe field of robotic cardiac surgery is experiencing a significant surge, poised for major expansion in the coming years. This momentum is fueled by recent technological breakthroughs and growing...